What Can You Write Off On Taxes 2025 - Top tax writeoffs that could get you in trouble with the IRS, The more you take advantage of, the lower your tax burden. However, you can deduct some of the cost from your gross income. If you secured a tax extension or are filing late, here are. This comprehensive guide takes you through the essentials, ensuring you’re aware of the deductions you can claim.

Top tax writeoffs that could get you in trouble with the IRS, The more you take advantage of, the lower your tax burden. However, you can deduct some of the cost from your gross income.

21 Things to write off on your taxes Payhip, What to claim, what to. This article is tax professional approved.

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png)

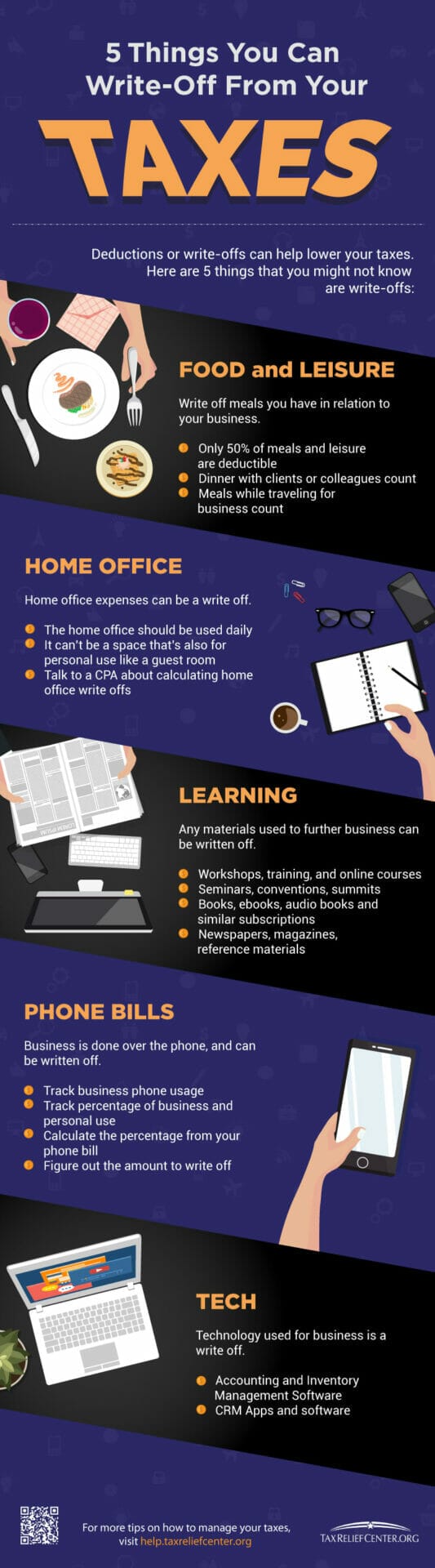

What Can You Write off on Your Taxes [INFOGRAPHIC] Tax Relief Center, You technically can't write off the entire purchase of a new vehicle. Depending on your financial situation, you can claim up to $4,000 in tax deductions.

However, you can deduct some of the cost from your gross income.

What To Write Off For Taxes Self Employed? TAX TWERK Self, Writing, Federal income tax returns for the 2023 tax year were due by april 15, 2025. However, you can research further in case.

WriteOffs Understanding Different Types To Save on Taxes, You technically can't write off the entire purchase of a new vehicle. Federal income tax returns for the 2023 tax year were due by april 15, 2025.

Federal income tax returns for the 2023 tax year were due by april 15, 2025.

What Can You Write Off On Taxes 2025. What to claim, what to. In this guide, we’ll cover everything you need to know about writing off meals:

/cloudfront-us-east-1.images.arcpublishing.com/gray/77LGGDMSDBBLVJIBVLRN2KQCZQ.jpg)

Vehicle Deduction For Business 2025 Esta Olenka, Gather your documents file your return . You can write off up to $11,160 for qualifying cars and $11,560 for qualifying trucks and vans, as long as you use the vehicle for business purposes more than 50% of the time.

Things To Write Off As A Business Expense Business Walls, Get answers to questions on itemized deductions and the standard deduction. You can use it to pay for courses at a college, university, or trade.

What Can I Write Off on My Taxes? Business tax deductions, Tax write, You technically can't write off the entire purchase of a new vehicle. You can use it to pay for courses at a college, university, or trade.

But there’s another tax break you might be able to claim.